Screeners for surveys are your first line of defense against people looking for freebies, or participants messing up your data. But the goal of survey screeners isn't just to filter out unqualified respondents — it's to find the right ones, who will make your research all the more meaningful.

Because even the most well-designed research study depends on one critical factor: getting input from the right participants. Quantity simply can't outrun quality. So if you want to know how to get even better insights from your next survey, read on.

What is a screener survey and why do you need it?

A survey screener is a set of targeted questions that helps identify ideal participants for your research study. You send it to them before sending them the actual study, to make sure you're asking the right people. But it's more than just a filtering tool — it's a strategic asset that shapes the quality and reliability of your entire research.

Depending on your target audience, survey screeners can range from straightforward and simple screener questions (Do you drink coffee?) to sophisticated multi-phase assessment tools (Do you drink coffee at least three times a week and prefer to brew it at home with a specific brand of coffee beans?).

For market researchers and product teams, screeners are the bridge between your research goals and reliable results. Especially for in-home usage tests (IHUT), but it applies to online surveys, concept testing and any other type of market research. Whether you're testing a new CPG product, validating claims, or gathering sensory feedback, starting with the right participants directly impacts the actionability of your data. It builds confidence in your implementation process.

Why screeners matter for product testing and online surveys

The value of a thorough screening process becomes especially clear in product testing scenarios, but is also often overlooked in other research scenarios. For example, you don't want to test curly hair shampoo on someone with straight hair. But the value of screeners is much more nuanced than that.

- Data quality (and in a way, quantity): When every response comes from someone who meets your exact criteria, you reach stronger statistical significance in your market research. Instead of filtering through responses afterward, you get the largest possible pool of data that isn't muddied with non-relevant respondents.

- Resource and ROI optimization: It costs money to send out product testing kits, and it also costs money to send out other survey types. Making sure your product samples or surveys reach the most relevant testers is smart budgeting.

- Research reliability: A screener survey gives you the confidence that your insights can be applied to your products or strategies.

For physical testing of CPG products, the list goes on:

- Minimize product waste in IHUT programs

- Reduce shipping costs to unqualified participants

- Optimize your research budget with targeted distribution

- Lower risk of invalid or unusable feedback

- The chance to reach early adopters and turn them into customers

The participant perspective:

Great screening doesn't just benefit researchers — it creates a better experience for participants too, which then benefits the research, which in turn…you get the drill:

- Participants feel more valued when properly matched to studies

- When screener questions for user testing and tasks align with their actual experiences, it becomes easier to answer

- They can make a more meaningful contribution to product development

- This all gives them increased motivation to provide thoughtful feedback

- Respondents experience reduced survey fatigue from relevant screener questions

''Screeners are a great way to gamify product testing. I signed up to be a Highlighter and I haven't qualified for a product test yet, because I haven't made it past the screener. It makes me more motivated to complete the screeners in hopes of getting chosen–fingers crossed that I’ll make it past a screener soon!''

- Highlighter Lacey R., Minnesota

Whether you're doing qualitative or quantitative research, it'll significantly improve if you send out a solid screener beforehand.

Understanding survey screeners: from basic to advanced applications

The complexity of your screener should match your research goals and methodology. Let's break down how they work and when to use different approaches, starting with some basic screener survey examples.

|

Basic Survey Screening Question Types |

Example |

|

Demographics and basic behaviors |

What is your age? or Do you own a smartphone? |

|

Simple yes/no qualification questions |

Have you purchased a product online in the last month? |

|

Standard market research criteria |

Do you make purchasing decisions for your household? |

Advanced screening can cover:

- Multi-step qualification process

- Behavioral validation checks

- Photo or video verification requirements

- Complex product usage patterns

- Geographic and lifestyle considerations

- Specialized expertise verification

- Technical knowledge assessment

- Current product ownership verification

- Usage expertise validation

For CPG, there are some extra steps you might want to keep in mind:

- Purchase history verification

- Usage frequency checks

- Brand preference validation

- Category involvement level

When to use different screening methods

Choosing just how far you want your screener to go, means you need in-depth knowledge of your target audience, your research goals. It matters whether you're doing quantitative or qualitative research, or a mix of both.

It's a misconception that online surveys by default require fewer qualification checks — it simply depends on the research objectives. But for IHUT, it's generally true that the stakes are much higher, so more rigorous screening is needed.

It's almost always a must in multi-phase studies, regardless of the format. If you want to track participant engagement over time and monitor data across different periods, you'll need to have a comprehensive understanding of consumer behavior — and screeners help you build that.

Accessing pre-qualified participant pools

Now, you don't have to start from scratch and send a screener survey to just about anyone. Working with established research partners like Highlight gives you access to:

- Already-screened, engaged participant communities

- Verified demographic and behavioral profiles

- Proven track records of quality participation

- Streamlined recruitment for specialized studies

This approach saves time while maintaining high standards — particularly valuable when you need specific demographics or behaviors for product testing. Learn more about our turnkey logistics in CPG product testing.

How to create an effective survey screener

Respondents are smart, so you need to outsmart them. When we needed to test a new autonomous lawnmower, participants had to prove they owned a current model. Of course, we required photo evidence. And still, we received numerous poorly photoshopped images of people "posing" with robot mowers.

This goes to show that you need to think one step ahead. Let's walk through the foundational components, and how to further foolproof your survey.

Clear qualification criteria:

- Specific demographic requirements: Define your target audience precisely – instead of "parents," specify "primary caregivers of children ages 2-5 who make household purchasing decisions."

- Behavioral patterns: Look beyond basic demographics to actual behaviors, such as "purchases organic snacks at least twice monthly" rather than just "buys organic food."

- Usage frequency thresholds: Set clear minimums for product usage – "uses facial moisturizer at least 5 times per week" tells you more than "uses skincare products."

- Geographic considerations: Consider how location impacts product usage; someone testing a winter coat in Florida will have different insights than someone in Minnesota.

- Required expertise levels: Define what "experience" means for your study — distinguish between casual users and genuine enthusiasts.

- Verification requirements: For specific criteria like hair type or product ownership, ask for photo or video verification with specific poses or other proof (like holding up two fingers, or a video with a product) to prevent stock photo submissions, or other lawn mower scenarios.

Avoiding response bias:

One of the most important goals of your screener survey is to avoid response bias. Here are some key strategies for your question design to gather authentic, unbiased responses:

- Neutral language in prompts: Instead of "How much do you love this product?" ask "What are your thoughts about this product?"

- Balanced response options: Include an equal number of positive and negative options in scales, and always consider adding a neutral option.

- No leading questions: Avoid screener questions that suggest a "right" answer, like "Most people prefer natural ingredients — do you?"

- Varied question formats: Mix multiple choice, rating scales, and open-ended questions to maintain engagement and catch inconsistencies.

- Randomized answer choices: Change the order of options to prevent pattern-based responding and maintain participant attention.

Quality indicators in screener responses:

So, your screener results come back in. What should you be paying close attention to? We'd look for these signals to assess participant quality:

- Consistent response patterns: Look for answers that align logically across different questions about similar topics.

- Detailed open-ended answers: Quality responses typically include specific examples and personal experiences rather than generic, vague or short statements.

- Accurate technical responses: When asking about specific products or categories, look for answers that demonstrate genuine familiarity.

- Genuine product knowledge: Responses should reflect real-world usage experience, rather than information that could be easily googled.

- Authentic usage examples: Look for specific, detailed examples of how products are used in daily life rather than vague generalizations.

Best practices for mobile-first design:

Most participants access surveys through their mobile devices, especially in CPG testing. That means there are a couple of technical optimization elements you should consider:

- Short, scrollable questions: Keep questions concise and visible without horizontal scrolling — no one wants to scroll side-to-side while holding their phone.

- Touch-friendly response options: Make buttons and checkboxes large enough to tap easily with a thumb, with enough spacing between options.

- Easy photo upload capabilities: Provide clear instructions for photo uploads and allow direct camera access for immediate submission.

- Clear progress indicators: Show participants how far they've come and how much remains to maintain engagement.

- Quick-loading interfaces: Optimize image sizes and minimize complex elements that could slow down mobile loading times.

Advanced screening techniques:

For complex product testing, particularly in IHUT scenarios, here's how you can use multi-phase screening to narrow down your participants even further to optimize your resources and increase your data quality:

Multi-phase screening

- Initial basic qualification: Start with straightforward demographics and basic usage questions before moving to more detailed screening.

- Secondary detailed assessment: Include specific product knowledge questions that only genuine users would know.

- Video response requirements: Ask participants to submit short videos demonstrating product usage or explaining their experience.

- Category expertise validation: Include questions that test deeper category knowledge beyond basic usage.

- Product usage verification: Request photos of current products in use or receipts of recent purchases.

- Red herring questions: We include seemingly unrelated questions — making it harder for participants to guess "right" answers.

6 Common screening mistakes to avoid

Of course, there are plenty of frequent pitfalls. Here's which ones to be aware of, and how to avoid them.

1. Survey bloat

- Keep your screener focused on essential criteria

- Choose quality over quantity – a few well-crafted questions beat dozens of surface-level ones

- Remember: Every extra question increases the risk of participant drop-off

2. Verification complexity

- Our robot lawn mower study taught us this lesson well: When participants submitted obviously photoshopped "proof" photos, we learned to request specific verification

- Keep photo and video submission processes simple and mobile-friendly

- Combine easy-to-submit proof with knowledge-based questions that only real users would know

3. Low-quality responses

- Watch for copy-paste answers in open-ended questions

- Look for unique responses that show genuine engagement

- Be alert to identical phrases across multiple submissions that might indicate AI-generated responses

4. Transparent screening criteria

- Instead of asking "Do you own a robot lawn mower?" ask participants to list all their lawn care equipment

- Hide your qualification requirements within broader questions

- Create questions that naturally reveal qualified participants without telegraphing what you're looking for

5. Leading questions

- Avoid questions that hint at preferred answers

- Frame questions neutrally to get honest responses

- Don't guide participants toward what you think they should say

6. Geographic and seasonal oversights

- Consider how location affects product usage – a winter coat study needs different criteria in Minnesota versus Florida

- Account for seasonal factors in your screening

- Adjust criteria based on regional availability and usage patterns

Using screeners to your strategic advantage

The difference between good and great product research often comes down to who's providing the feedback. But effective screening is more than just a filtering tool – it's an opportunity to shape your entire research strategy.

At Highlight, we're maintaining a 48% acceptance rate for our product tester community. The goal isn't to get that number up, but to be as selective as we can be, to ensure quality to our users. Our screening processes enable us to reach incredibly specific audiences. Not to brag, but we've even recruited participants in their 38th week of pregnancy, which only has a 0.2% national incidence rate, for postpartum supplement testing.

An additional benefit we see is that when done right, your screening data can inform your broader research approach:

- Use screening responses to identify unexpected user segments you hadn't considered

- Leverage participant backgrounds to personalize follow-up questions

- Spot emerging trends in how consumers interact with your product category

- Build a community of trusted participants for long-term research relationships

Schedule a demo today to discover the power of qualified, engaged participants.

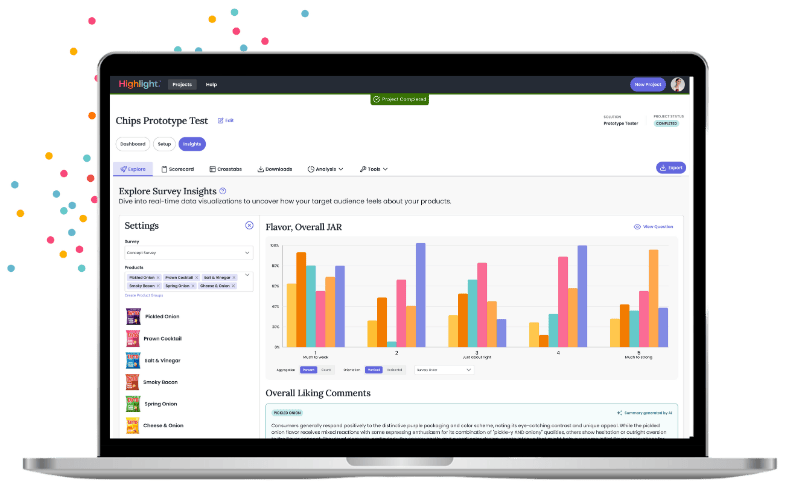

Tour the Highlight Platform

Get your questions answered and see the platform in action with a personalized demo.

![[Image] Highlight team Holiday party 2022](https://www.letshighlight.com/hs-fs/hubfs/%5BImage%5D%20Highlight%20team%20Holiday%20party%202022%20.png?width=1920&height=1080&name=%5BImage%5D%20Highlight%20team%20Holiday%20party%202022%20.png)